The top five supply chain risks to double down on in 2022

In light of the global supply chain crisis, the report highlights ongoing risks like ocean freight bottlenecks growing labor unrest, increased inventory leading to higher costs for companies, and an increased regulatory framework from governments around the world

January 23, 2022: Even as there seems to be no end to the onslaught of the global supply chain crisis and pandemic shortages, companies around the world are pivoting to newer ways of mitigating risk in the post-pandemic world and using new technologies to make this transition to operating an uncertainty-filled world.

However, what is some blind spots that they should consider as they move forward in these uncertain times when it comes to their supply chains?

The recently released ‘2022 Annual Supply Chain Risk Report’ from leading supply chain risk analytics provider Everstream Analytics lists the top 5 supply chain risks that global companies should prepare for in the next 12 months.

- Worldwide water instability creates threats

As per the report, 5 out of 11 global regions now see water stress values above 25%, including two regions with high water stress and one with extreme water stress, according to the UN and two-thirds of the global population will face water shortages by 2025. This threat is mounting due to population growth, rapid industrial and urban expansion, as well as more and more extreme weather events like drought and floods. Water instability will even affect companies operating in water-abundant regions as interconnected supply chains expose companies to risk from drought-prone regions.

More stringent government regulations

Factors like scarce water supply are going to lead to more stringent government regulations in the coming future. Recent water consumption regulations in key areas along the Yangtze River in China, for example, have highlighted the growing impact for industrial manufacturers. More such restrictions are likely to be passed due to growing water scarcity.

Scarce water supply

In April 2021, a severe drought in Taiwan forced many companies to adopt water rationing measures. Companies will be mandated to start adopting water conservation measures like installing water-saving technology or mandated water resource management. Meanwhile, extreme heat and low rainfall mean that cargo transportation on inland waterways is particularly exposed to these risks, causing intermittent disruptions to barge traffic due to stark changes in water levels.

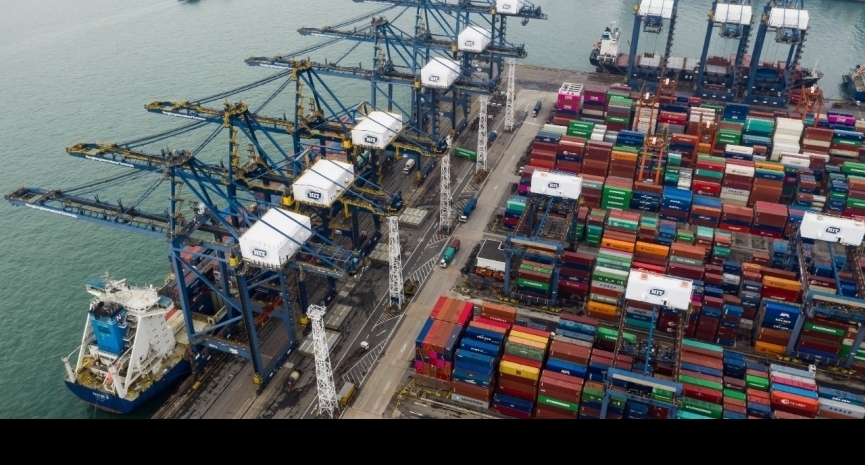

- Ocean freight bottlenecks cascade

Facing record low-inventory levels, strong consumer demand, and ongoing Covid-19 impact on logistics and workforces, the global ocean cargo industry will continue to suffer from port congestion and delays in 2022.

Port worker & Covid-19 outbreaks

The ongoing pandemic outbreaks will continue to impact operations, leading to temporary closures of terminals or entire ports and causing longer waiting times for vessels.

High yard utilization and import volumes

Consumer behavior changes amid the covid-19 restrictions and lockdowns are leading to increasing port congestion. The Port of Los Angeles (largest in North America) and the Port of Tan Cang Cat Lai (largest in Vietnam) both reported yard utilization over 100 percent when 80 percent is considered full capacity. Persistently high imports, coupled with acute labor shortages, will continue to stress yard utilization and lead to delays.

Maritime transport interconnectivity

Port dependencies have been amplified by 2021 disruptions, many related to the covid-19 pandemic. The six-day Suez Canal blockage, which halted maritime traffic in one of the world’s most important waterways in March 2021, has been a stark reminder of how a single event can reverberate through global supply chains, further upending already strained logistics bottlenecks

- The great resignation continues

Workers are abandoning supply-chain-related jobs in record numbers, in what has been dubbed “the great resignation.” Changes in workplaces and labor negotiations during the pandemic have shifted the balance of power from employers to labor unions.

A reliable workforce remains elusive

Strike actions have increased in health care, logistics, food, and manufacturing sectors, disrupting operations in places that had not seen labor actions in decades. A reliable workforce will remain elusive due to ongoing illness from pandemic variants. as covid-19 variants continue to spread across the world and the risk of infection will force companies to reassess workplace safety and worker compensation. Not only will key workers remain at risk themselves, but they may need to adjust work hours or abandon jobs to care for sick family members.

Growing labor unrest

The threat of strikes will continue to hang over labor negotiations in 2022, and unions should be expected to press for improved working conditions in any sectors that have been criticized over security concerns and low pay

- Just-In-Time shifts to Just-In Case

The report cites that as the pandemic exposed flaws in “just in time” inventory systems, businesses have been exploring a shift to the “just in case” model, increasing buffer and safety stocks of critical components or best-selling products. According to the U.S. Department of Commerce, total business inventories have increased by 7.8 percent in October 2021 compared to the same month in 2020.

Increased Inventory

Throughout 2021, businesses from machinery makers to drink manufacturers said they were likely to increase safety stocks of critical components to protect against special-cause variation in demand during extreme weather, supplier failures, or a “black swan” event. However, ongoing shipping delays mean that many companies will have higher inventory levels than planned in 2022. This will increase costs for extra goods, require more warehouse space and labor, insurance, obsolescence, or outdated inventory – particularly risky for low-margin industries.

Undecided forecasting

Lockdowns and border closures will delay any normalization to past mid-2022. Given the ongoing uncertainty, multinational companies will change how they manage inventory, potentially by decentralizing stocks to place them closer to customers, providing localized stockpiles to use up during supply chain disruptions.

- Regulatory Scrutiny ramps up

Sustainability disclosure and reporting requirements for businesses continue to gain momentum amid scrutiny from governments, investors, and customers alike.

Human rights issues in focus

Further regulations impacting global supply chains will likely be enacted in 2022. While reputational risks continue to be a key incentive and driver for ESG performance, there is now a general trend towards legal action against such concerns, turning sustainability into a material business risk. Both Norway and Germany have already passed supply chain laws on human rights due diligence, holding companies accountable for violations, including those taking place at the supplier level, and more countries and trading blocks are likely to follow suit.

Climate Change Impact

Upstream emissions in the value chain, so-called scope 3 emissions, are estimated to be, on average, 11 times greater than emissions from a company’s own direct operations. Several companies have pledged to exclusively purchase ocean-freight services powered by zero-carbon fuels by 2040, as the International Maritime Organization adopted new measures that will require the shipping industry to reduce their annual average co2 emissions by 40 percent by 2030. 2022 will see further ambitious regulations and pledges, raising the bar for increased accountability on supply chain sustainability amid increasing pressure from global stakeholders.