Drewry index up 61%, Maersk to divert all vessels

Maersk has decided to divert all its vessels around Cape of Good Hope for foreseeable future

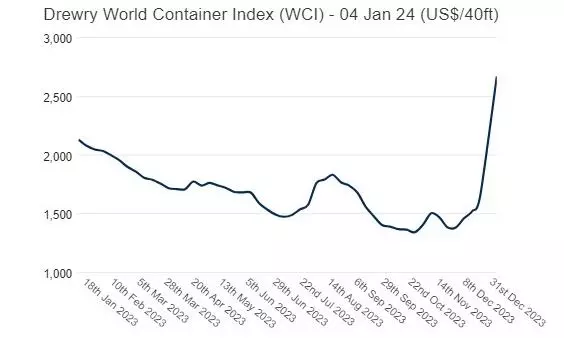

Drewry’s World Container Index increased 61 percent to $2,670 per 40ft container this week.

The index has increased by 25 percent when compared with the same week last year, according to the latest update.

The index is now 88 percent more than the average 2019 (pre-pandemic) rate of $1,420, the update added.

"The average composite index for the year-to-date is $2,670 per 40ft container, which is $3 lower than the 10-year average rate of $2,673 (which was inflated by the exceptional 2020-22 Covid period)."

Freight rates on Shanghai to Rotterdam more than doubled to $3,577 per FEU. Rates on Shanghai to Genoa also more than doubled to $4,178 per 40ft box.

Shanghai to Los Angeles rates increased by 30 percent to $2,726 per 40ft container.

"Rates on Shanghai to New York increased by 26 percent to $3,858 per FEU. Also, rates on Rotterdam to Shanghai were up 17 percent to $546 per 40ft box."

Drewry is expecting East-West spot rates to increase in the coming weeks due to the Red Sea/Suez situation.

Maersk diverts all vessels

Danish carrier Maersk has decided to divert all its vessels around the Cape of Good Hope for the foreseeable future.

"On January 2, 2024, Maersk announced that it would pause all vessels bound for the Red Sea/Gulf of Aden in light of the recent incident involving Maersk Hangzhou and on-going developments in the area. The situation is constantly evolving and remains highly volatile, and all available intelligence at hand confirms that the security risk continues to be at a significantly elevated level," says the latest update.

By suspending voyages through the Red Sea/Gulf of Aden, Maersk hopes to bring customers more consistency and predictability despite the associated delays that come with the re-routing.

"While we continue to hope for a sustainable resolution in the near future and do all we can to contribute towards it, we do encourage customers to prepare for complications in the area to persist and for there to be significant disruption to the global network."

Maersk also announced that the Transit Disruption Surcharge (TDS), Peak Season Surcharge (PSS) and Emergency Contingency Surcharge (ECS) for all cargo on vessels affected by the disruptions around the Red Sea/Gulf of Aden continue to remain in effect.

Uncertainty to persist

"Day 21 of the Red Sea crisis, and the past day has seen both a hijacking and an attack with a drone boat," says Lars Jensen in his LinkedIn post.

"The detailed view of the Houthis’ weaponry and capabilities seems to indicate that a military confrontation is likely to be protracted."

No safe haven when container shipping, supply chains are disrupted as we see right now in the Red Sea, writes Peter Sand, Chief Analyst, Xeneta. "Especially when the other key maritime short-cut/chokepoint, the Panama Canal is battling with largely reduced capacity due to the current low water level in Lake Gatun. No quick fixed to any of these issues."

Shippers should be on the very top of their own maritime transportation requirement, "always but especially during times like this. Chinese Lunar New Year coming up too. Securing capacity and equipment is king, and freight rates keep rising and transit times extends."

“The Red Sea is a vital artery for global trade which is currently blocked," says Christian Roeloffs, Founder and CEO, Container xChange. "Thankfully, there are ways to circumvent that artery and keep the global trade moving, and therefore the trade is not stopped. The Red Sea situation is acute but not chronic in the long term for the shipping industry.”

There are still many geopolitical risks that have the potential to significantly impact shipping trade in 2024, according to the latest update from Container xChange. "We have the Israel –Hamas war, the related situation in the Red Sea, the Russia-Ukraine war with no end in sight, tensions between China and Taiwan and an increasing enlargement of the BRICS block."

What can have a far-reaching and long-term impact on the global supply chain is the BRICS inclusions of more economies, adds Roeloffs.