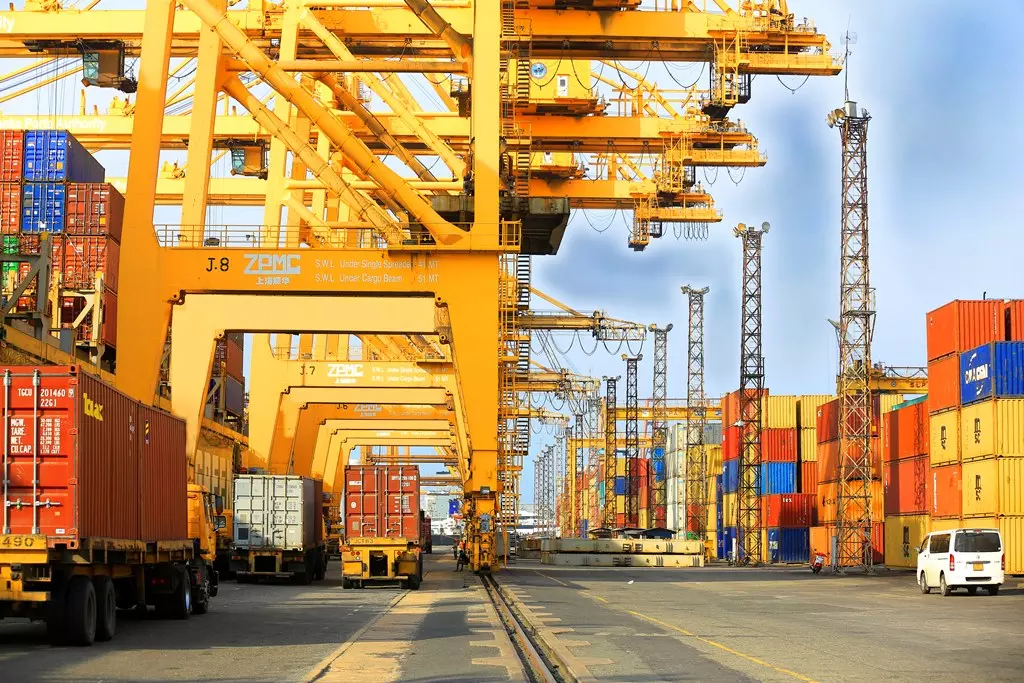

Colombo Port operational amidst forex issues, container backlog

In the past few weeks, there had been a shift in cargo moving to Indian ports located in south and western India

Sri Lanka's economic crisis has had a cascading effect on its maritime activity and especially that of the Colombo port which is a key transshipment hub of the South East Asia region. Trade operations had slowed down in Sri Lanka since February owing to a massive forex crunch followed by fuel scarcity.

Transshipment diversion to Indian ports is being observed due to the crisis in Sri Lanka, cited Container xChange recently. "The result of the Sri Lanka crisis, one of many, has been observed as the CAx for Chennai and Nhava Sheva rose. Meaning inbound containers have increased at these ports. At the port of Nhava Sheva, the CAx value increased from 0.70 to 0.75-0.76 and is expected to rise in the coming weeks. At the port of Mundra, the CAx is 0.63 at week 14 and is expected to go up to 0.73 in the next few weeks. Transshipment diversion to Indian ports is being observed due to the crisis in Sri Lanka," stated a reply to Logistics Update Africa(LUA) from Container xChange.

In the past few weeks, there had been a shift in cargo moving to Indian ports located in south and west India, mainly Cochin, Thoothukudi, Chennai, Mundra, and Pipavav owing to congestion in Sri Lanka, and more are expected to shift to Vallarpadam International Container Transshipment Terminal and ports in Tamil Nadu mainly. Interestingly the transshipment volume at ICTT, Vallarpadam for the month of March 2022 increased by 62% (13,609 TEUs) compared to March 2021 (8394 TEUs).

Truckload service issues owing to gasoline stockouts in Sri Lanka had led to vehicle shortages with Colombo terminals facing container backlogs. This had led to ships diverting to Indian ports but industry sources say the number is still less.

Cochin Port Trust chairperson M Beena told LUA, "There have been reports that of late some shipping lines have started skipping Colombo which may not be solely due to congestion. The process of shifting transshipment volume to Cochin started in the later part of 2020, which is evident by the fact that the transshipment volume at ICTT, Vallarpadam increased to 86,761 TEUs for the year 2020-21 from 36,183 TEUs handled in the year 2019-20 (a growth of 140%). In the year 2021-22, the transshipment volume has increased to an all-time high of 156,159 TEUs, a growth of 80% over 2020-21. These volumes were primarily contributed by some new services as well as by the existing ones. Moreover, there were occasional 'ad-hoc' vessels that also called at Cochin."

Strain on container lines

Several international shipping lines have begun skipping Colombo Port due to the current economic crisis and communicated the same to their customers. Maersk Line for one is diverting export shipments out of India's east coast to JNPT/Nhava Sheva with the help of dedicated block trains.

Vikash Agarwal, Managing Director, Maersk South Asia, told LUA, "We are facing some challenges in the operations in Sri Lanka on ocean and landside transportation of the logistics ecosystem. With the current congestion at the ports in Colombo, we have decided to move the export cargo out of the East Coast to West Coast by running dedicated block trains. By doing so, we are avoiding transshipment through Colombo, thus trying to reduce the pressure on the ports in Sri Lanka and also ensuring that our customers get better transit times by skipping delays. We have run four block trains so far and a couple more are in the pipeline."

"We see that the congestion can continue for some time, and we are monitoring the situation closely and studying different alternative plans. At the moment we are discussing different strategies, either train or other feeding options. Colombo does not only handle cargo to/from India but also to/from Bangladesh. This is why it is crucial for us to study various options carefully in order not to add further delays to the current situation," said Mohamed Badawy, Senior Director of Operations, Region Middle East at Hapag-Lloyd to LUA.

Forex crunch looms large

Reacting to the forex crunch faced by the island nation, leading shipping line Ocean Network Express (ONE) on 8 April, issued a change in freight payment to its customers that cited, "With reference to the shortage of USD in Sri Lanka and the devaluation of LKR (Sri Lankan Rupee) that followed, in order to continuously provide a reliable service we would like to only accept shipments with 'Freight prepaid' into Sri Lanka. This will not affect the shipments that are already 'Freight Prepaid' and is to be in effect starting 11 April as the booked date."

India also depends on Colombo port in terms of global trade as 60 percent of India's transshipment is handled by the port. Earlier this February, Sri Lanka's forex crunch had hit Indian shippers and there was also the issue of export cargo lying uncleared at Colombo port.

Isaac Thiagarajan, Managing Director of Chennai-based Contiship Logistics told LUA that exporters are still wary of sending cargo to Sri Lanka considering the economic crisis and the fear that they may not be paid. He said, "The crisis is affecting Indian exporters as cargo which is supposed to go into Sri Lanka is not going in because it is getting stuck at the port. This is because one has to pay the banker and the banker has to remit the cash and get your documents which is not happening because there are no dollars to go out of the country. So there is a lot of cargo that is stuck in the port where the importers (in Sri Lanka) are not able to bring the cargo into the country because they don't have the required documents. As of now our customers have reduced or literally stopped their exports towards Sri Lanka and trade has literally stopped and likely will come to a grinding halt shortly. Cargo is definitely moving via Vallarpadam and Mumbai ports which are emerging as options."

Slow recovery of export cargo lying at Colombo Port

Rotation of boxes between India and Sri Lanka was affected in February this year after export cargo lay uncleared at Colombo port after a sharp depreciation of the Sri Lankan Rupee against the USD that led to a major cash crunch.

Thiagarajan said, "Exports out of Sri Lanka are nearly zero today because everything is in different places and there is no fuel for them to move shipments to the port. More than 7-8000 containers were still stuck till about a week ago. These contained commodities like vegetables, rice, chemicals, pharmaceuticals, etc. When you do not clear the consignment at a particular time, there is going to be demurrage, and detention charges amidst high inflation in Sri Lanka. So it is essential for Sri Lankan importers to bring out the stuck cargo and I believe evacuation of shipments lying in Colombo is also slowly happening."

Giving a ringside view of the Sri Lankan crisis affecting maritime activity, key importer and trader Abdul Saliheen, the Managing Director of Colombo-based Paramount Impex P. Ltd says that the issue will be a prolonged one.

"Sri Lanka is mainly an import-dependent country and currently importers are unable to import any items because of lack of dollars or foreign exchange required for us to import essential items like food items, medicines, fuel, etc. Our port is functioning smoothly but these days there is a little bit of a delay in calling by the main vessels. Now the shipping companies do not accept payment in Sri Lankan Rupees because there is a dearth of dollars, so they insist on payments in US dollars. So arrival has gone down a bit, but transshipment of cargo is going on. I don't see there to be a short-term relief from this situation and it is expected to go on for some time because we are not getting enough dollars or loans and grants from other countries and banking institutions. Meanwhile, our own earnings and exports of industrial products have also gone down as there is no way of importing raw material to manufacture here," he said.

Fuel shortage expected to ease up

As reports of yard congestion and slowdown continue, the Sri Lanka Port Authority (SLPA) Chairman Dr. Prasantha Jayamanna recently told CNBC that port operations are up and running. He said, " We have not stopped any day of work and things are moving flawlessly because we have our own oil reserves with us and in fact, we have a separate company called JCT Oil Bank that imports oil for trade and bunkering purposes, because of which the port is continuing without any issue. News media must be referring to some of the local truckers who are getting the goods from the port to the country who must be having an issue. But transshipment wise and internally inside the port, everything is smoothly going on."

Rohan Masakorala, Founder and CEO of Shippers' Academy Colombo told LUA, "As far as the port is concerned it is running 24/7 without any issues at the moment. Some of the transshipment boxes have been stacked up in the yards for some time, so there is a little bit of yard congestion and operation. That backlog is there in the terminals. Overall it is working without any interruptions from the power and the shortage of fuel. There was a short period when inter-terminal trucking got affected because the number of trucks that could be deployed was reduced because of the shortage of diesel but it has now been sorted out. The credit line given by India may also bring in a lot of fuel, so the fuel shortage is expected to ease off within the next few days. None of the main liners have canceled any of their major routes via Colombo, while some lines have indicated that they will skip Colombo to avoid the current situation of getting delayed in loading etc. With respect to the transshipment backlog, while things are moving, some of the shipping lines have kept their boxes for some time. Obviously, the local industry's position has been to move them out and keep the large space available for more and more business."