Global logistics execs see coming surge of African investment

Egypt has Africa’s highest-ranked domestic logistics opportunities; South Africa tops in Africa for international logistics; Morocco has Africa’s best business fundamentals; Kenya (9) is Africa’s most digitally ready.

Credit: Agility Emerging Markets Logistics Index

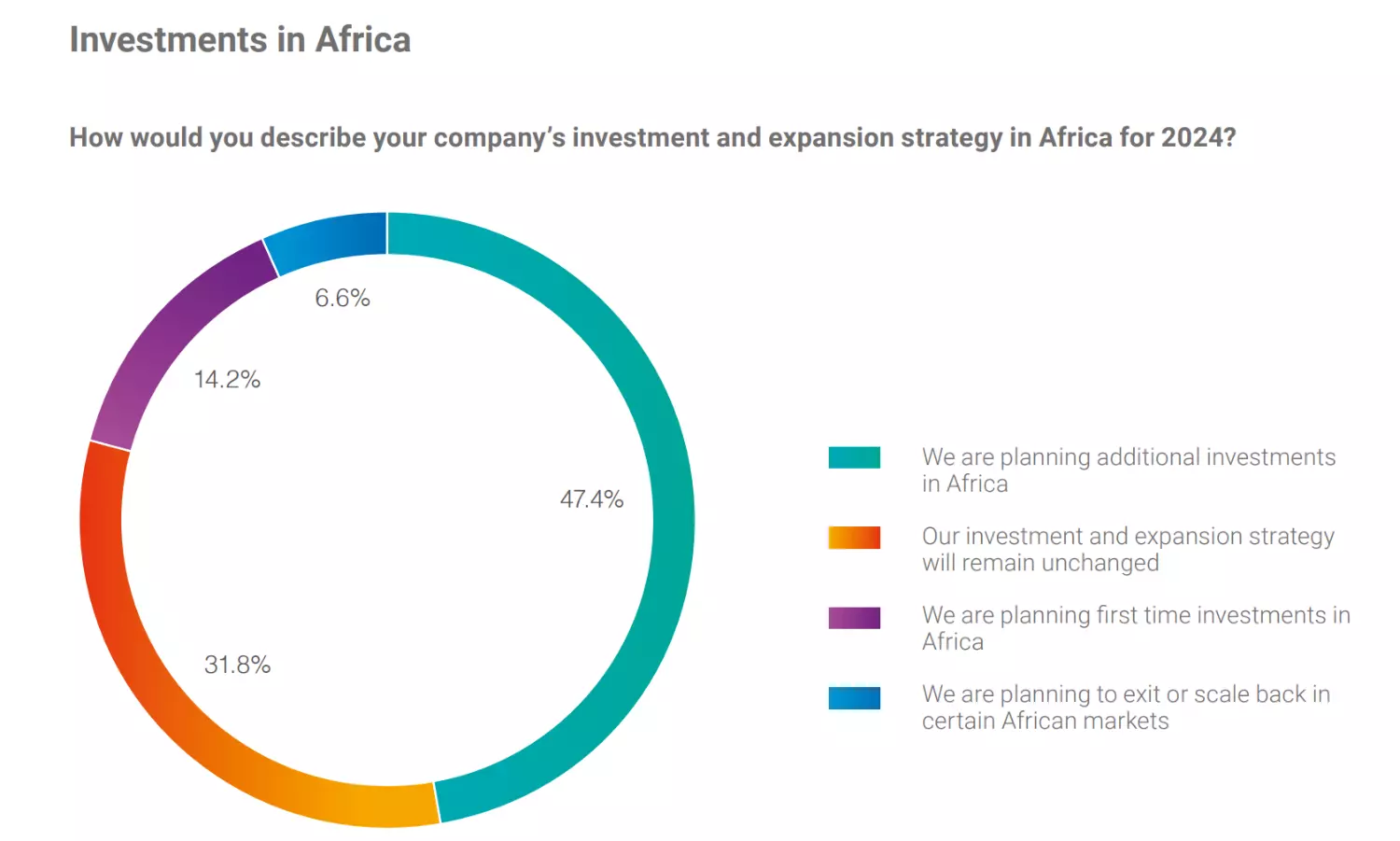

Nearly 62 percent of global logistics professionals say their companies are planning additional or first-time investments in Africa, according to the survey which is part of the 15th annual Agility Emerging Markets Logistics Index.

“This is the most optimism we’ve seen about Africa in the 15 years of the Index,” says Agility vice chairman Tarek Sultan. “Africa’s population will double by 2050, when one in four people on the planet will be African. International businesses realize that the time is now for Africa -- they need to invest, establish their brands, and develop the next generation of African talent if they’re going to ride the coming wave of growth.”

The survey of 830 logistics executives is a snapshot of industry sentiment and ranking of the world’s 50 leading emerging markets.

The Index ranks countries for overall competitiveness based on their logistics strengths, business climates and digital readiness -- factors that make them attractive to logistics providers, freight forwarders, air and ocean carriers, distributors and investors. In the 2024 Index, the rankings of most African economies changed little from a year earlier, but businesses indicate they are looking ahead at massive population growth and trade expansion spurred by the African Continental Free Trade Area (AfCFTA).

China and India were 1 and 2 in the 50-country Index rankings. In Africa, Egypt (20), Morocco (22), South Africa (24) and Kenya (25) were the top performers, followed by Ghana (31), Nigeria (36), Tunisia (37), Tanzania (41), Algeria (42), Uganda (43), Ethiopia (45), Mozambique (46), Angola (47), Libya (50).

Egypt has Africa’s highest-ranked domestic logistics opportunities -- 13th in that category; South Africa (15) was tops in Africa for international logistics; Morocco (12) has Africa’s best business fundamentals; Kenya (9) is Africa’s most digitally ready – and the continent’s highest-ranked country in any category.

More than 63% of survey respondents say their companies continue overhauling supply chains by spreading production to multiple locations or relocating it to home markets and nearby countries. China, the world’s leading producer, stands to be most affected: 37.4% of industry professionals say they plan move production/sourcing out of China or reduce investment there.

Shipping and logistics costs that soared during the COVID pandemic and its aftermath are still climbing but at a slower rate, the survey found. One way shippers expect to cope is by increasing use of digital freight forwarding from 37.8% today to 52% in five years.

Transport Intelligence (Ti) has compiled the Index since it was launched in 2009.

John Manners-Bell, chief executive of Ti, said: “Supply chain managers are still coming to terms with the political and economic instability characterising the post-COVID global economy. Geopolitical relationships are changing rapidly, and this is having a major impact on international trade and risk profiles. Businesses need to be alive to the opportunities and threats that exist in emerging markets and use data, such as that the Agility Emerging Market Logistics Index, to inform agile decision-making.”