Shippers hold upper hand in airfreight rates negotiations

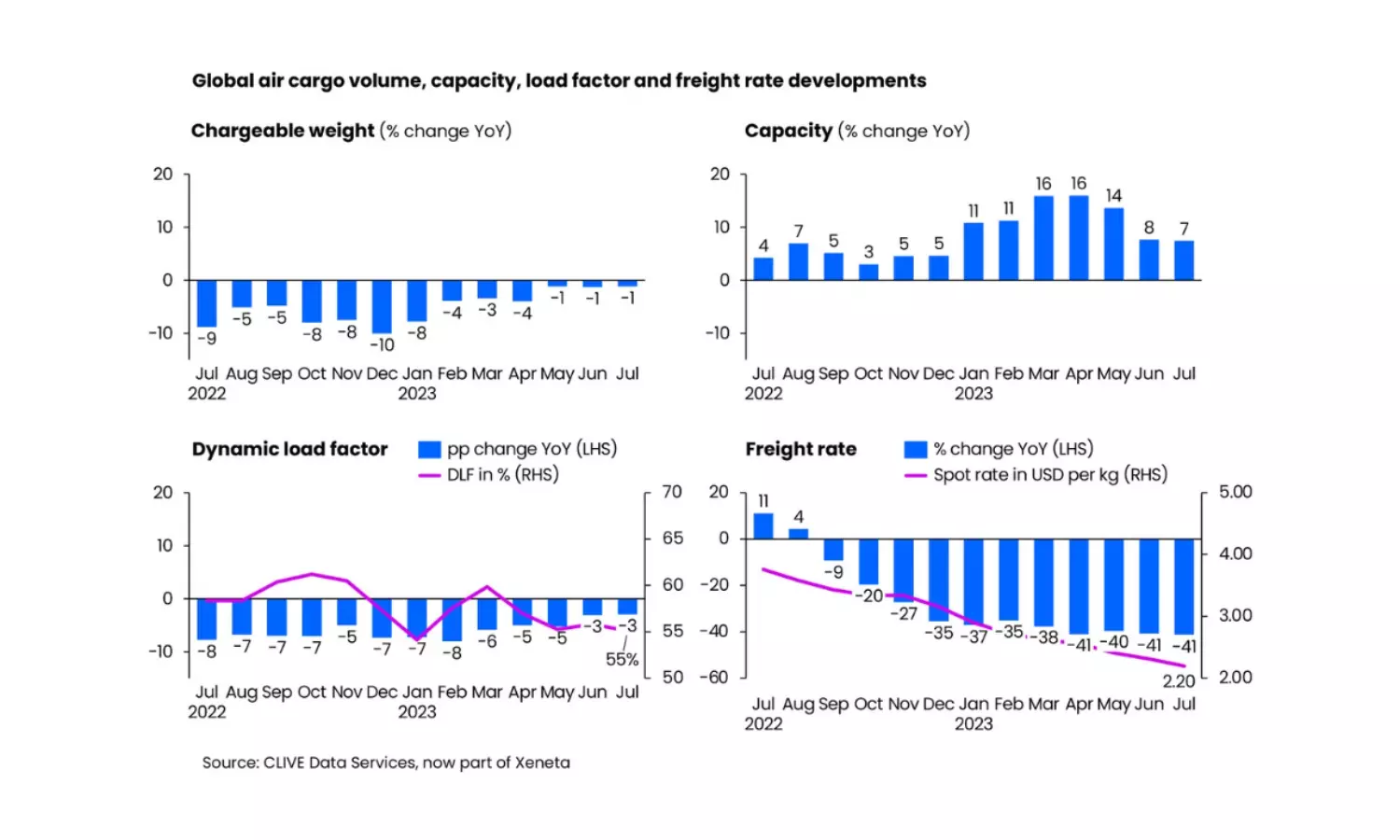

Last month saw a 7% YoY capacity recovery as airlines’ summer schedules stepped up to meet heightened passenger traffic.

Shippers relaunching airfreight contract negotiations to push rates down

Shippers to hold the upper hand in the next round of winter airfreight rates negotiations after another month of falling demand in July saw volumes drop 2 percent month-over-month and more shippers are already relaunching contract negotiations with their logistics service providers.

“The general global air freight spot rate declined at a hastening pace of 40 percent or more for a fourth consecutive month, according to the market analysis by CLIVE Data Services, part of Xeneta.

Last month saw global air cargo capacity recover by +7 percent compared to a year ago, as airlines’ summer schedules stepped up to meet heightened passenger traffic. In line with this, the July global average dynamic load factor, which measures cargo load factor based on both volume and weight perspectives of cargo flown and capacity available, was at 55 percent, on a par with June 2023 but -3 percent pts below the level of a year ago.

More capacity at a time of falling volumes placed added pressure on airfreight rates. The 41 percent drop in July versus the same month in 2022, pushed the average air cargo spot rate down to $2.20 per kg. This compares to a rate of $2.31 per kg recorded in June.

“The month of July rarely provides any surprises in terms of unexpected performance levels in the global air cargo market, but what will be concerning airlines and forwarders is the constant month-on-month decline in average rates, and the quickening pace of this fall since the turn of the year,” says Niall van de Wouw, chief airfreight officer at Xeneta. “Going into the usually critical winter rates negotiation period, it’s clear shippers will have the upper hand. We are already seeing more shippers relaunching contract negotiations with their logistics service providers to push down airfreight rates. Shippers are also looking to agree longer, 12-month commitments to reduce their costs. Airlines will know they can expect the same pricing turbulence from forwarders.

“The airfreight rates merry-go-round will be intense this winter, as we have indicated in previous months’ analyses. Many freight forwarders, who at the peak of the pandemic chose multi-year contracts to secure airline capacity, are now reportedly bleeding cash, so they are under significant pressure to renegotiate rates which reflect the reality of today’s freight market and the expectation that the current market environment could continue for the foreseeable future into 2024.”

The key question for all stakeholders monitoring the global air cargo market demand is: ‘how low will it go?’

Looking at weekly developments in July, the global air cargo spot rate bottomed out in the second week of the month, while in the final week, ending on 30 July, it ticked up 3 percent, possibly reflecting an easing decline in cargo volumes and slower paced growth in capacity versus previous months.

In addition, the recent rise in jet fuel prices might also have contributed to the increase, having already been seen in some shippers’ monthly rate revisions. But the uptick in jet fuel surcharge will likely not manage to stick and provide any meaningful impact on freight rates, as demand and supply dynamics for the general air freight market remain unchanged. With shippers enjoying leveraging their enhanced buying power after the pricing pain of the pandemic, Xeneta expects a push back on the fuel surcharge adjustments, too.

Zooming into the corridor level, Northeast Asia (including China) trade lanes registered the biggest rate declines compared to last year. Both China to the US and US to China airfreight spot rates fell 60+ percent from a year ago. China to Europe and Europe to China took the third and fourth places, with spot rates down over 55 percent year-on-year.

South America to the US and Europe to the Middle East and Central Asia registered the smallest rate declines of 19 percent and 27 percent respectively, compared to a year ago.

The volatile market conditions are being reflected in the Q2 performance levels being reported by airlines and global forwarders, with the ‘top 3’ airfreight forwarders – Kuehne+Nagel, DHL Global Forwarding, and DSV - all registering contraction of around 50 percent in their Q2 2023 air revenues compared to the same period a year ago.

While forwarders are clearly suffering from the significant drop in general airfreight volumes, those targeting higher yielding clients and commodities are still gaining higher margins, despite also seeing a drop in volumes. This is generating some recourse to the high competition in the general cargo market, where high competition means the spot rate (valid for up to one month) has fallen below the seasonal rate (valid for over one month) since May last year. In comparison, cargo requiring special handling continues to produce higher yield, with the spot rate above the seasonal rate since the onset of the pandemic.

Those forwarders focused on grabbing volumes almost at any cost to increase their market share will continue to sacrifice their margins to do so, and likely continue to fuel an irrational air cargo market in which global spot freight rates fall deeper the level market fundamentals and conditions would typically expect.

For the remainder of this summer, Xeneta anticipates airfreight volumes will remain muted. This is indicated in the latest manufacturing Purchasing Manager Index (PMI) from China. The manufacturing powerhouse’s official PMI ticked up to 49.3 in July from 49.0 in June, indicating a continuing decline in the country’s manufacturing, and extending this fall in production to a fourth consecutive month. Its subindex for new export orders, a bellwether for air cargo demand, dropped to 46.3 in July from 46.4 in June.